Vi’s 20% Users Inactive: IIFL Report Exposes Gap Between Reported and Real Numbers

Vodafone Idea’s One in Five Users Are Inactive: IIFL Report

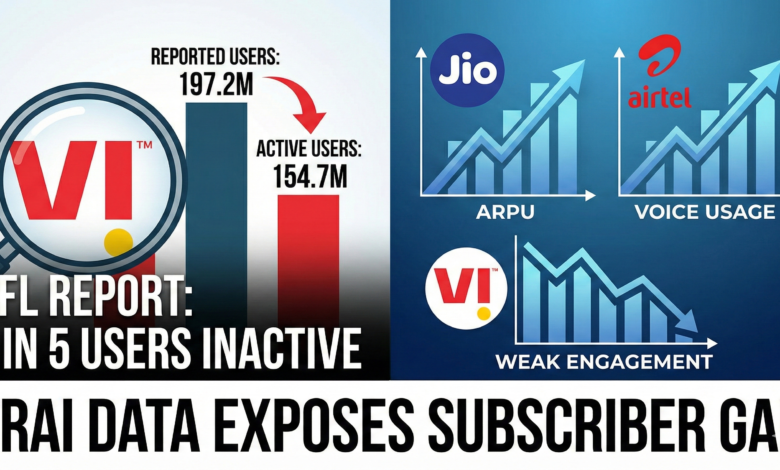

A new report by IIFL Capital, citing TRAI data, has revealed a startling statistic: more than one in five Vodafone Idea (Vi) users are inactive. This finding highlights a significant disconnect between the subscriber numbers reported by the company and the actual users active on the network.

More Than 20% of Subscribers Exist Only on Paper

The report exposes a core structural weakness in Vi’s user base:

-

Vi reported a total subscriber base of 197.2 million for the June–September quarter.

-

However, based on other parameters, the report estimates Vi has only 154.7 million active users.

-

This indicates that over 20% of its reported user base is inactive.

When 2G numbers are removed, the 154 million active base (essentially 4G users) shrinks even further, exposing a fragile high-value user base.

Real ARPU vs. Reported ARPU

On paper, Vi’s Average Revenue Per User (ARPU) for Q2 FY26 was Rs 167, which lags behind Airtel (Rs 256) and Jio (Rs 211.4). However, when IIFL recalculated the ARPU by removing low-revenue Machine-to-Machine (M2M) SIMs and focusing only on active users, the picture changed:

| Telco | Reported ARPU (Q2 FY26) | Recalculated (Active Users) ARPU |

| Vodafone Idea (Vi) | Rs 167 | Rs 209 |

| Reliance Jio | Rs 211.4 | Rs 220 |

| Bharti Airtel | Rs 256 | N/A |

Even with the recalculation, Vi’s Rs 209 is still lower than Jio’s recalculated ARPU of Rs 220.

Voice Usage: The Weakest Link

In India, which remains the world’s largest voice market, voice engagement is a critical metric. TRAI’s October usage data shows that Vi customers are far less engaged than their counterparts:

-

Vi: 746 minutes/month (active subscribers)

-

Airtel: 1,071 minutes/month

-

Jio: 1,105 minutes/month

TRAI October Data: A Month of Heavy Losses

According to TRAI’s October wireless report, the market trends moved in opposite directions for private players:

-

Reliance Jio added 2.7 million 4G/5G users.

-

Bharti Airtel added 2 million users.

-

Vodafone Idea lost 2.08 million subscribers, marking the worst performance among private telcos.

Looking at the Active Subscriber (VLR) metric—which reflects actual customer presence on the network—the divergence is even starker:

-

Jio added 3.9 million active subs.

-

Airtel added 2.8 million active subs.

-

Vi lost 0.4 million active subs.